Author: SRCO Business Insights | December 26, 2024

As we move further into the digital age, more government services in Bangladesh are embracing online systems to improve convenience and accessibility. One such critical service is the tax return verification online in Bangladesh. For businesses and individuals alike, ensuring that your tax returns are correctly submitted and verified is a legal obligation and a step toward financial transparency. Online platforms now streamline processes such as identity verification, ensuring taxpayers can easily access their records and verify their income tax returns. Responding promptly to an identity verification notice from the National Board of Revenue (NBR) is essential to avoid delays in processing.

Furthermore, verifying your tax return is crucial to safeguard against identity theft, which could compromise sensitive information like your social security number. For those eligible for refunds, electronic funds transfer or direct deposit options ensure quick access to funds without the hassle of physical paperwork. As you manage your tax responsibilities for the current tax year, adopting secure verification practices will enhance your financial data’s safety and expedite processes. This guide by S. Rahman & Co., a trusted Chartered Accountancy firm, will help you navigate the online tax return verification process confidently in 2025.

Why Is Tax Return Verification Important?

Before diving into the steps and security measures, let’s understand why tax return verification is vital:

- Legal Compliance: Verifying your tax returns confirms that you’ve met the National Board of Revenue (NBR) legal requirements.

- Avoiding Penalties: Failing to verify your tax returns can result in fines, penalties, or legal complications.

- Proof of Tax Payment: Verification provides evidence that your tax obligations have been met, which can be essential for personal or business records.

- Loan and Visa Applications: Verified tax returns are often required when applying for loans or visas.

- Strengthening Financial Credibility: A verified tax return enhances your financial standing with stakeholders and institutions.

Steps to Verify Tax Returns Online in Bangladesh

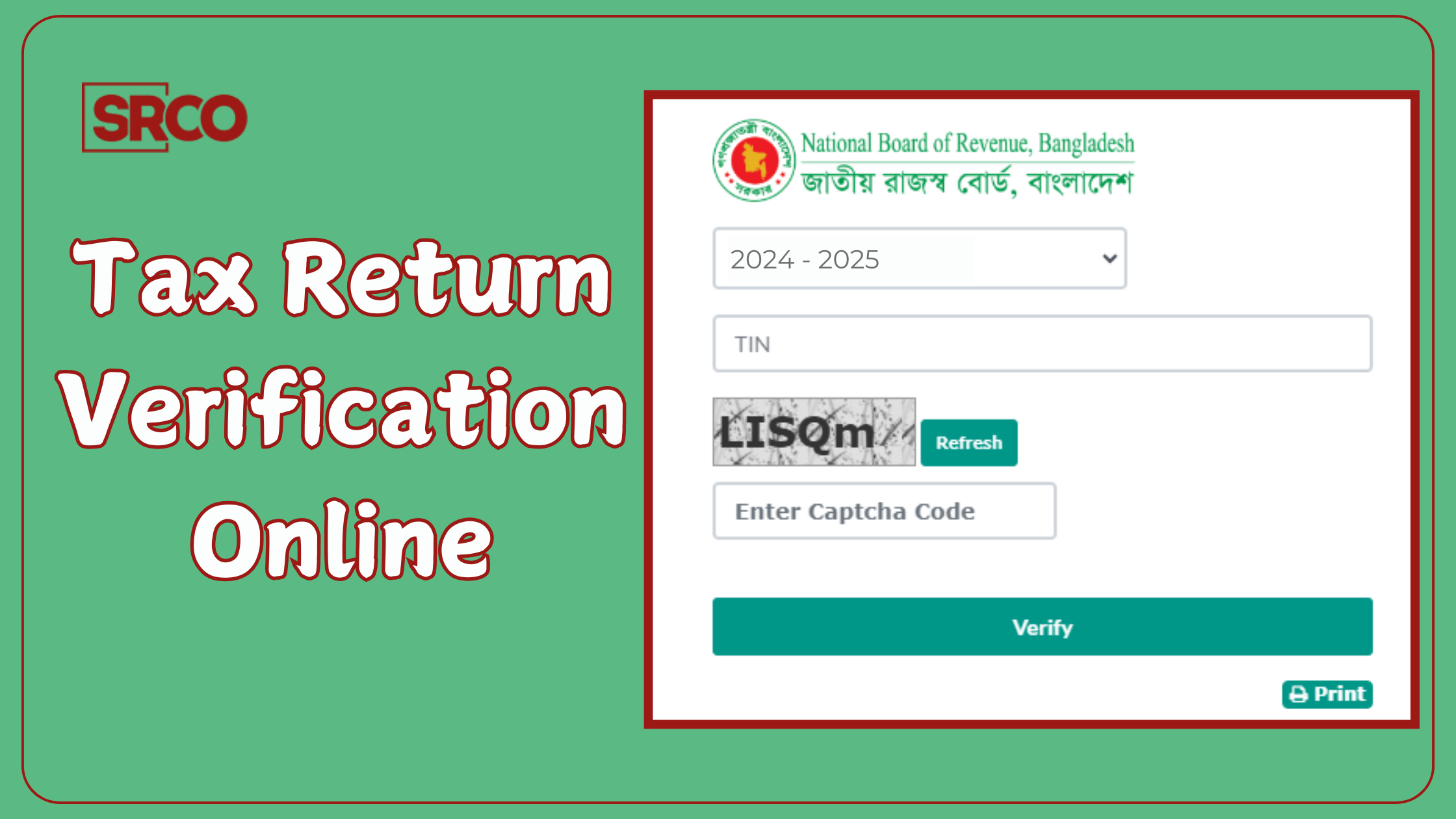

Step 1: Access the NBR E-Return System

- Visit the official National Board of Revenue (NBR) portal at www.nbr.gov.bd.

- Navigate to the e-Return section designed for online tax filing and verification.

Step 2: Log In to Your Taxpayer Account

- Log in using your registered Taxpayer Identification Number (TIN) and password.

- Ensure your login credentials are secure and not shared with anyone.

Step 3: Submit Your Tax Return

- Complete the necessary forms online if you haven’t already submitted your tax return.

- Double-check all entered data, such as income details, deductions, and tax payable, to avoid errors.

Step 4: Request Verification

- After submitting your tax return, locate the verification section.

- Click on “Verify Tax Return” to initiate the process.

Step 5: Receive Acknowledgment

- Once the verification request is processed, you will receive an acknowledgment receipt or email confirming the successful verification.

Step 6: Download and Save Verification Proof

- Always download and save the proof of verification for future reference.

Security Tips for Tax Return Verification Online

Ensuring the security of your sensitive financial data is crucial when dealing with online tax systems. Follow these best practices to protect yourself:

- Use Strong Passwords

- Create a unique and complex password for your TIN account.

- Use a combination of letters, numbers, and special characters.

- Enable Two-Factor Authentication (2FA)

- Activate 2FA if available on the NBR portal to add an extra layer of security.

- This requires a second verification step, such as an OTP sent to your mobile or email.

- Verify the Website’s Authenticity

- Ensure you are on the official NBR website (www.nbr.gov.bd) and not a phishing site.

- Check for “https” in the URL and a padlock icon in the address bar.

- Avoid Public Wi-Fi

- Never use public or unsecured Wi-Fi networks when accessing your tax account.

- Opt for a secure private network or a VPN service for added security.

- Regularly Monitor Your Account

- Periodically log in to your TIN account to check for unauthorized activities.

- Report any discrepancies to the NBR immediately.

- Keep Your Devices Secure

- Install reputable antivirus and anti-malware software.

- Regularly update your operating system and browser to patch security vulnerabilities.

- Beware of Phishing Scams

- Do not click on suspicious links or emails claiming to be from the NBR.

- Verify all communication through official channels before responding.

Common Issues and Solutions in Online Tax Verification

Issue 1: Forgotten Password

- Solution: Reset your password by using the “Forgot Password” feature on the login page. Ensure you have access to your registered email or phone number.

Issue 2: Website Downtime

- Solution: Retry accessing the portal during non-peak hours. If the issue persists, contact the NBR helpline.

Issue 3: Incorrect Data Entry

- Solution: Double-check your entries before submission. If an error is found after submission, consult a CA firm like S. Rahman & Co. for rectification assistance.

Issue 4: Verification Delays

- Solution: Ensure all documents and information are correctly uploaded. Follow up with the NBR if delays exceed the usual timeframe.

Advantages of Verifying Tax Returns Online

- Convenience: The process can be completed from the comfort of your home or office.

- Time-Saving: No need to stand in long queues at tax offices.

- Immediate Acknowledgment: Receive verification proof instantly.

- Paperless: Reduces the need for physical documentation.

- Secure Storage: Digital records are easier to store and retrieve.

How S. Rahman & Co. Can Assist You

Navigating the intricacies of online tax return verification can be challenging, especially for first-time users or those unfamiliar with the digital process. That’s where S. Rahman & Co. comes in. As a leading Chartered Accountancy firm in Bangladesh, we provide:

- Expert Consultation: Guidance on accurately preparing and submitting tax returns.

- Error-Free Filing: Assistance in avoiding common errors that lead to verification issues.

- Security Assurance: Advice on safeguarding your financial information online.

- End-to-End Support: From filing to verification, we’re here every step of the way.

Future Trends in Tax Return Verification

As technology evolves, the processes for tax return verification continue to advance, offering enhanced solutions for tax filers. By 2025, online services are expected to become more robust, enabling taxpayers to use their Individual Taxpayer Identification Number (ITIN) for secure access. AI-driven systems will streamline identity verification, reducing errors and mitigating tax-related identity theft. Blockchain technology could ensure tamper-proof tax records, benefiting federal tax return filers and fiduciary income tax cases. Mobile apps will allow individuals and non-tax filers to submit estimated tax payments, check filing status, and track refunds in real time. These apps will also facilitate online requests for signed copies of tax records or identity verification letters. Integrating such services eliminates reliance on the postal service, speeds up processes, and reduces the risk of tax fraud. The income tax department’s focus on advanced tools ensures efficiency for tax preparers and filers, enhancing security and transparency.

Final Thoughts

Securing your tax return verification online in 2025 is about following the steps and being vigilant against cyber threats. You can ensure a smooth and secure verification process by adhering to the outlined security measures and leveraging professional support from S. Rahman & Co.

Stay proactive, stay informed, and make tax compliance a seamless part of your financial journey. For personalized assistance or more information, don’t hesitate to contact us at S. Rahman & Co. Together, let’s build a future of financial transparency and security in Bangladesh.

Blogs