In the recent budget proposal, Finance Minister Abul Hassan Mahmood Ali has recommended increasing the marginal tax rate 2024 for Bangladesh’s highest income bracket from 25 percent to 30 percent. While a 30 percent tax rate may appear steep at first glance, it’s essential to understand that Bangladesh follows a progressive tax system. Under this system, taxpayers are not taxed at a flat rate on their entire income; instead, different portions of income are taxed at varying rates. As a result, only the portion of an individual’s income that falls into the highest bracket will face the 30 percent rate. Most taxpayers’ effective tax rate — an average rate based on the progressive brackets — will be significantly lower than 30 percent.

This increase aims to create a more equitable tax landscape, ensuring higher earners contribute more to the country’s revenue. The proposed adjustment aligns with the government’s focus on balancing economic growth with social responsibility, aiming to fund essential public services and infrastructure. Although high-income earners will see an increase in their tax contributions, the overall tax impact will vary widely depending on income levels, with lower-income individuals facing much lighter tax burdens.

The progressive tax system is a structure in which tax rates increase as income rises, aiming to distribute the tax burden fairly across income levels. In this system, higher-income individuals are taxed at higher rates than those with lower incomes. This structure is based on the principle that those who earn more have a greater ability to contribute to public finances. For example, income might be divided into brackets, each taxed at an increasing rate. Progressive taxation is often used to fund public services, social welfare programs, and infrastructure, helping to reduce income inequality by ensuring that wealthier individuals contribute proportionately more. While supporters believe it promotes economic balance and fairness, critics argue it may discourage high earners and stifle economic growth. Overall, the progressive tax system aims to balance the needs of society with individual financial contributions, supporting a fair distribution of resources.

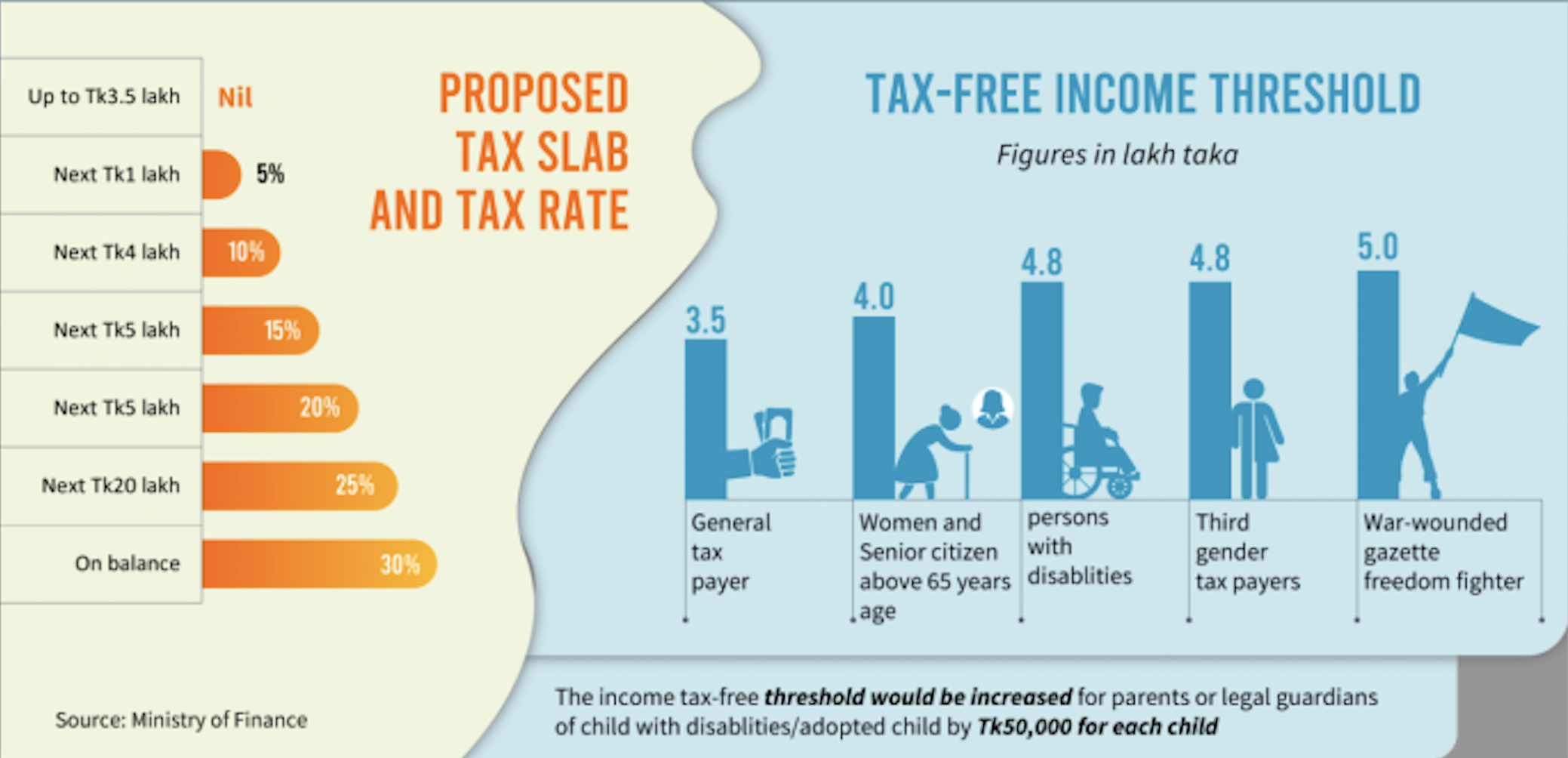

Here’s a breakdown of the proposed tax slabs for the current year:

Let’s examine examples to understand how this progressive tax system translates into real-world tax obligations.

In this case, even though the individual’s income is Tk 4,00,000, they only pay a 5% tax on the Tk 50,000 that exceeds the tax-free threshold, resulting in an effective tax rate of 0.625%.

Here, the individual pays no tax on the first Tk 3,50,000, 5% on the next Tk 1,00,000, and 10% on the remaining Tk 3,00,000, leading to an effective tax rate of 4.67%.

For someone earning Tk 50,00,000 annually, the tax calculation spans multiple slabs, ultimately resulting in an effective tax rate of 21.3%, far below the highest marginal rate of 30%.

A progressive tax system is structured to ensure that individuals with higher incomes contribute a larger share of national revenue, reflecting their greater capacity to pay. By aligning tax responsibilities with income levels, the system promotes economic equity, safeguarding lower-income individuals from undue financial strain and preventing them from being overburdened by taxes.

In a progressive system, income is divided into brackets or “slabs,” each taxed at a different rate. This approach means that a person is only taxed at higher rates on income portions exceeding certain thresholds. For example, while a 30 percent tax rate might seem intimidating, it doesn’t apply uniformly to all income. Instead, lower income portions are taxed at lower rates, and only the upper portions of income reach higher tax rates. As a result, the overall tax burden is typically much lighter than many expect, particularly for middle and lower-income earners.

This structure not only supports fairness but also encourages financial growth. People can retain more of their income as they build wealth, knowing that only the highest increments of their earnings will be subject to the steepest taxes. A progressive tax system thus balances revenue generation and individual financial freedom, helping governments fund public services without discouraging personal economic advancement. The progressive system promotes a fair and growth-friendly economy through this balanced approach.

Blogs