Author: SRCO Business Insights | December 29, 2024

In Bangladesh, VAT (Value Added Tax) is an essential part of the taxation system, and businesses need to comply with the National Board of Revenue (NBR) regulations to stay legally compliant. If your business’s annual turnover exceeds the VAT registration threshold, you will be required to register for VAT. Understanding the VAT registration process and how to prepare your business for it is crucial for smooth operations and financial planning.

This guide provides a detailed explanation of the steps you need to take to prepare your business for VAT registration, ensuring you meet all the legal requirements and avoid potential fines or issues with the NBR.

What is VAT Registration?

VAT registration is the process by which a business becomes officially recognized by the NBR as a taxable entity under the VAT law. Once registered, your business will be obligated to collect VAT on its taxable supplies (sales of goods and services) and remit it to the government. In return, you may also claim VAT on your business-related purchases.

Businesses with a turnover exceeding a specific threshold (usually BDT 30 lakhs per annum for goods and services) are required to register for VAT in Bangladesh. Smaller businesses may voluntarily opt for VAT registration if they wish to claim VAT on their purchases or expand their market credibility.

Why is VAT Registration Important for Your Business?

- Legal Compliance: VAT registration ensures your business complies with the tax laws of Bangladesh, avoiding penalties or legal action.

- Input Tax Credit: By registering for VAT, you can claim input VAT on your purchases, which can be used to offset the VAT you owe on your sales.

- Business Credibility: VAT registration adds credibility to your business, as customers and suppliers often prefer dealing with VAT-registered entities.

- Access to Market Opportunities: Being VAT-registered opens doors for larger business contracts and collaborations, as many clients and suppliers prefer working with registered businesses.

Step 1: Understand the VAT Registration Threshold

The first step in preparing your business for VAT registration is determining whether your business meets the registration requirements. In Bangladesh, businesses that have an annual turnover exceeding BDT 30 lakh (BDT 3 million) are required to register for VAT. However, businesses below this threshold may also opt for VAT registration if they want to claim input tax credits or benefit from certain tax advantages.

- Threshold for Goods: BDT 30 lakh annual turnover.

- Threshold for Services: BDT 30 lakh annual turnover for service providers.

- Voluntary Registration: If your turnover is below the threshold, but you wish to claim VAT on business-related purchases, you may apply for voluntary registration.

Step 2: Evaluate Your Business Structure and Operations

Before applying for VAT registration, assess your business structure and operations. The NBR may require additional documentation or specific procedures for certain types of businesses, such as sole proprietorships, partnerships, limited companies, or non-profit organizations.

- Business Type: Are you operating as a sole proprietorship, partnership, or limited company? The structure of your business may impact your VAT registration process.

- Nature of Goods and Services: Understand whether the goods or services you provide are subject to standard VAT rates or are exempt or subject to reduced rates.

- Business Location: The location of your business (head office and branches) will be relevant for VAT registration, as some businesses may need to register multiple locations.

Step 3: Organize Your Business Financial Records

One of the key aspects of VAT registration is ensuring your business maintains clear, accurate, and up-to-date financial records. Proper bookkeeping will help you comply with VAT regulations and make the registration process smoother.

- Sales and Purchase Records: Keep detailed records of all transactions, including sales invoices, purchase invoices, and receipts. This will be necessary for VAT reporting and for claiming input tax credits.

- Financial Statements: Ensure that your financial statements are current, accurate, and reflect the true state of your business’s finances.

- Cash Flow and Tax Calculations: Maintain a record of your business’s cash flow and make sure you track any VAT payable on sales (output VAT) and VAT paid on purchases (input VAT).

- Accounting Software: Consider using accounting software that is designed to handle VAT calculations and can generate reports needed for VAT filing.

Step 4: Designate a Responsible Person for VAT Management

VAT registration and compliance require ongoing management. To ensure smooth operation and adherence to regulations, designate a qualified person to handle VAT-related responsibilities.

- Internal or External Accountant: Decide whether to appoint an in-house accountant or hire an external professional to manage VAT filings, ensure compliance, and calculate VAT payable.

- VAT Reporting: The responsible person should be familiar with VAT laws, ensure timely filing of VAT returns, and accurately report VAT collected and paid.

- Tax Consultant: In case your business lacks internal expertise in VAT matters, hiring a tax consultant or advisor from a reputable firm like “S. Rahaman & Co.” can ensure your business stays compliant.

Step 5: Register with the National Board of Revenue (NBR)

Once your business is prepared and meets the registration criteria, the next step is to apply for VAT registration with the National Board of Revenue (NBR). The process involves several steps, including submitting the required documentation and completing forms. Below are the key steps involved in VAT registration:

- Obtain Necessary Documents: The NBR requires several documents for VAT registration, including:

- A copy of the trade license or business registration certificate.

- National ID card or passport of the business owner(s).

- Bank account details.

- Details of business premises.

- Financial records (balance sheet, profit and loss statement).

- Sale/purchase invoices for the last 6 months.

- Submit the VAT Registration Application: Visit the NBR’s VAT Registration website or your local VAT office to submit the VAT registration form. The form will require basic business details, such as name, address, and ownership structure.

- Verification by NBR: The NBR will verify the submitted documents and may schedule a site inspection of your business premises to confirm the information provided.

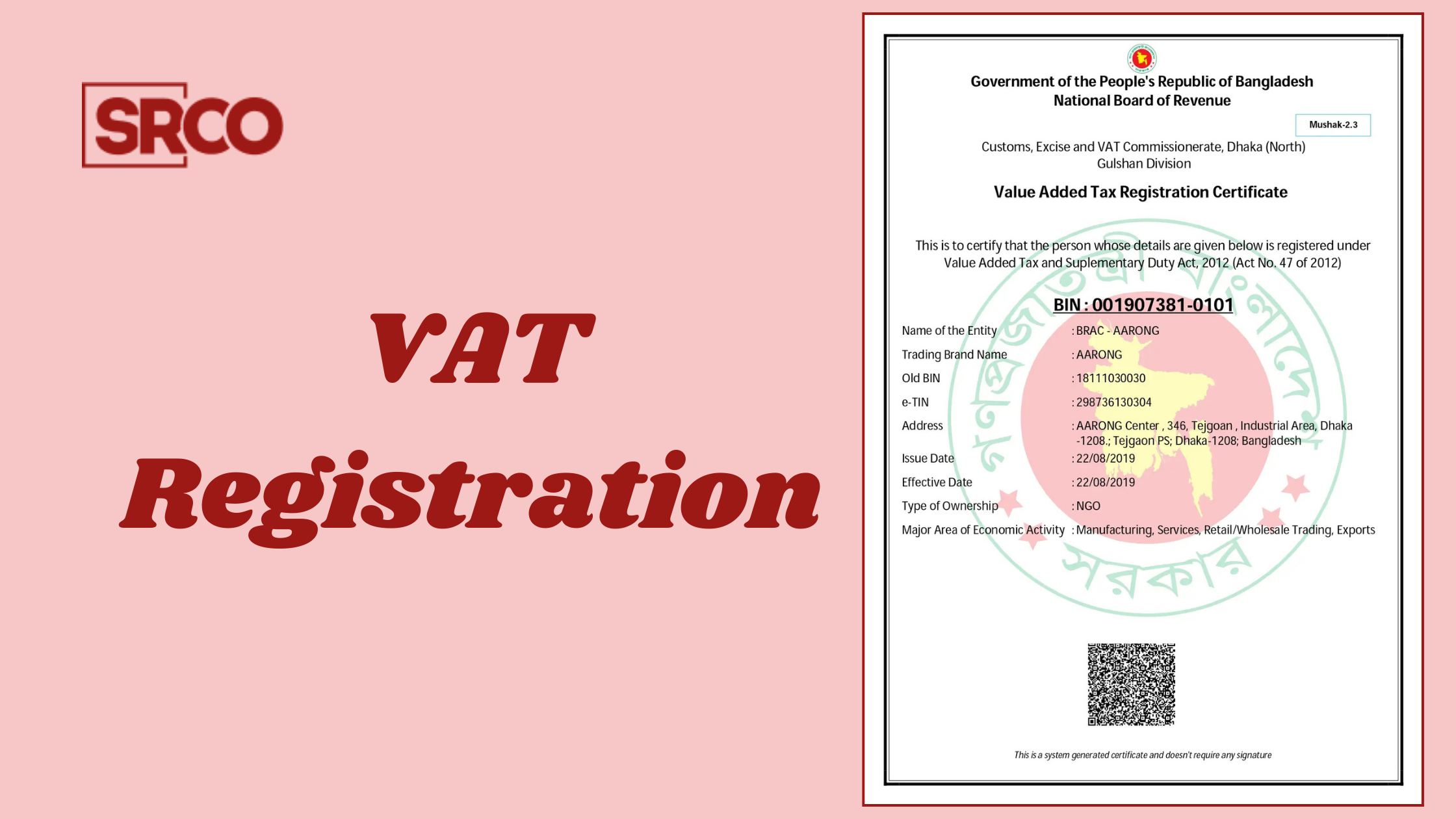

- VAT Registration Number: Once approved, the NBR will issue a VAT registration number (TIN), and your business will be officially registered for VAT. This number must be quoted on all invoices, contracts, and correspondence related to VAT.

Step 6: Set Up VAT-Compliant Systems

Once your business is VAT-registered, it’s crucial to implement systems that will ensure VAT compliance moving forward. The following systems should be put in place:

- Invoice System: Your business should issue VAT-compliant invoices for every sale, which clearly display:

- The total sale amount

- VAT charged (output VAT)

- VAT registration number of the seller

- Customer’s VAT registration number (if applicable)

- Accounting System: Use an accounting system that supports VAT accounting, tracks input and output VAT, and generates VAT reports. This ensures accurate filing of VAT returns and avoids errors in tax calculations.

- Stock and Inventory Management: If your business deals with physical goods, ensure that you have an organized system for tracking stock levels and ensuring that VAT is applied to the correct items.

- Employee Training: Ensure that key staff members are trained to understand VAT compliance, including how to handle VAT-inclusive pricing, issue proper invoices, and manage VAT reports.

Step 7: Prepare for Ongoing VAT Filings and Payments

After VAT registration, your business will need to file VAT returns and make regular payments to the NBR. Generally, VAT returns are filed monthly or quarterly, depending on your business size. These returns will include:

- Total sales and the VAT collected on those sales

- Total purchases and the VAT paid on those purchases

- The difference between output and input VAT (net VAT payable or refundable)

Your business will need to remit the net VAT payable to the NBR, either online or at designated banks.

Common Challenges in VAT Registration

While VAT registration is essential for business growth and compliance, many businesses face challenges during the process. Common issues include:

- Confusion over VAT Classification: Not all goods and services are subject to the same VAT rates, so determining which goods or services are exempt or subject to reduced rates can be confusing.

- Incorrect Documentation: Businesses often fail to provide the necessary documentation, which can delay the registration process.

- Failure to Track VAT Payments: Some businesses may have difficulty maintaining accurate records of VAT paid and collected, leading to errors in VAT filings.

Conclusion

Preparing your business for VAT registration in Bangladesh involves more than simply applying for a VAT number-it requires careful planning, proper documentation, and system implementation. By following the steps outlined in this guide, your business will be well-equipped to meet VAT compliance requirements, avoid potential fines, and maximize the benefits of VAT registration.

At S. Rahaman & Co. we specialize in providing professional VAT consultancy services to help businesses navigate the complexities of VAT registration, filing, and compliance. Our team of experts can assist you with every step of the VAT registration process and ensure your business stays compliant with Bangladeshi tax laws.

Blogs